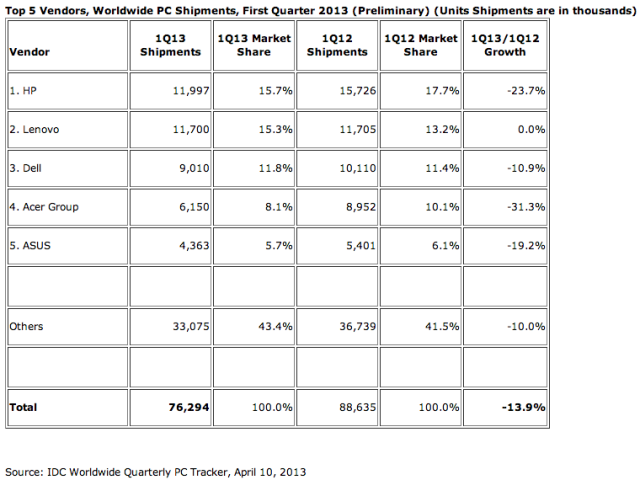

The bad news keeps on coming for most of the major PC makers, who were already dealing with poor holiday sales. Market research firm IDC reports that first quarter worldwide PC shipments are down 13.9 percent from the same quarter last year, the worst year-over-year decline since IDC began tracking shipments in 1994.

"Fading Mini Notebook shipments have taken a big chunk out of the low-end market while tablets and smartphones continue to divert consumer spending," said IDC's report. "PC industry efforts to offer touch capabilities and ultraslim systems have been hampered by traditional barriers of price and component supply, as well as a weak reception for Windows 8."

In short, netbooks are gone, Ultrabooks aren't selling as well as they could be, and things with touchscreens are succeeding at the expense of more "traditional" computers. IDC's report spends much more time blaming Windows 8 for the decline, going on to say that it "appears to have slowed the market" rather than supplying the sales bump that new Windows versions have provided in the past. But Windows 8 is certainly not the only culprit.

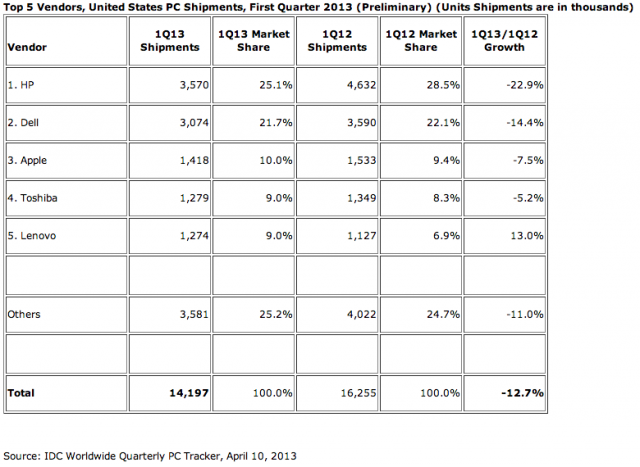

The two biggest losers (both worldwide and in the US) were HP and Dell, whose global shipments were down 23.7 and 10.9 percent from the first quarter last year, respectively (or, in hard numbers, a drop of about four million units for HP and about one million units for Dell). These numbers are almost certainly made worse by ongoing corporate issues at both companies: HP's issues are numerous and well-documented, while Dell is trying to buy the company back from the shareholders while simultaneously making an IBM-like pivot from being a consumer hardware company to a software-and-services company.

By comparison, Lenovo has been running smoothly, and hasn't wavered in its commitment to the PC market. As such, its shipments stayed level worldwide at 11.7 million, and actually increased 13 percent (1.1 million) in the US—it was the only company listed to do so, though PC makers not in the top five for each territory are all lumped together, so data for smaller companies couldn't be analyzed. This wasn't enough to stem the losses from the rest of the PC makers, but since Lenovo is selling the same Windows 8 as everyone else, their performance shows that it's possible to do well selling the new operating system.

There's also Apple, a company whose sales should be positively affected (if anything) by a negative reaction to Windows 8. The company's worldwide sales aren't enough to put it in the top five, but its US sales are down 7.5 percent (some 110,000 units) from last year. The difference here is that IDC counts neither iOS nor Android devices as PCs—while Apple's Mac sales may be depressed, its iPad sales are going to more than make up for them. This is also applicable for PC makers who also make successful Android phones and tablets, Samsung and Asus among them.

As for the other PC makers, Acer is down 31.3 percent (1.8 million units) worldwide, Asus is down 19.2 percent (1.1 million units) worldwide, and everyone else is down a combined 10 percent (3.7 million units) worldwide. Asus, Acer, Toshiba, and many of these other companies are more active in the consumer market and in inexpensive devices like netbooks and low-end laptops—these devices are going to be particularly susceptible to cannibalization from tablets, and are generally more volatile than the businesses that HP, Dell, and Lenovo all cater to with many of their products.

IDC's numbers make two things clear: the first is that consumers and businesses are going to notice and respond when your company acts like it might pull out of the PC market, as evinced by Dell's and HP's numbers especially. The second is that if you make PCs but you haven't also been able to gain a toehold in tablets or phones, you may have a harder time of it going forward. If the PC market continues to contract, it's only going to become more competitive.

Looking ahead to the next quarter, we know that Intel is due to release new chips based on the "Haswell" architecture soon, and with those chips will come most of the PC makers' second wave of Windows 8 systems. There's a chance that these new chips (and the new designs they help to enable) will be able to convince more people to buy new PCs.

However, buying a new computer because of new hardware just isn't as necessary as it once was. Windows 8 requires no more horsepower to run than did Windows 7, which in turn would run on just about anything that would run 2006's Windows Vista. Some 38 percent of Internet users are apparently still perfectly happy with the twelve-year-old Windows XP. Windows 8, cannibalization by tablets, and corporate instability aren't going to make the situation any better, but the fact of the matter is that most people seem content with the computers they already have.

reader comments

199